Conceptual Architecture

Architecture guide

The NFM Payment Gateway is a modern, microservices-based payment system built using a serverless-first approach. This overview introduces the key concepts and architecture of the system.

Core Principles

Our system is built on these fundamental principles:

- Serverless First: Utilizing GCP Cloud Functions/Cloud Run for event-driven, stateless services

- API-Driven: All communication via well-defined APIs

- Event-Driven: Using GCP Pub/Sub for asynchronous communication

- Managed Services: Leveraging managed services to reduce operational overhead

- Security by Design: Implementing multi-layer security

Architecture Overview

The system is composed of decoupled microservices, each with specific responsibilities:

Frontend Applications

- Management Platform: Next.js-based interface for House administration and Agent operations

- Deployment: Google Cloud Run with SSR capabilities

Core Services

- User & Agent Management: Handles user accounts, profiles, and permissions

- Device Management: Manages device registration and status tracking

- Transaction Processing: Handles recharge and payout operations

- Reporting: Provides comprehensive transaction analytics

Key Technologies

Tech Stack Highlights

- Frontend: Next.js with TypeScript & Tailwind CSS

- Backend: Node.js with TypeScript

- Database: PostgreSQL (Cloud SQL) & Firestore

- Message Bus: Google Cloud Pub/Sub

- Authentication: Firebase Authentication

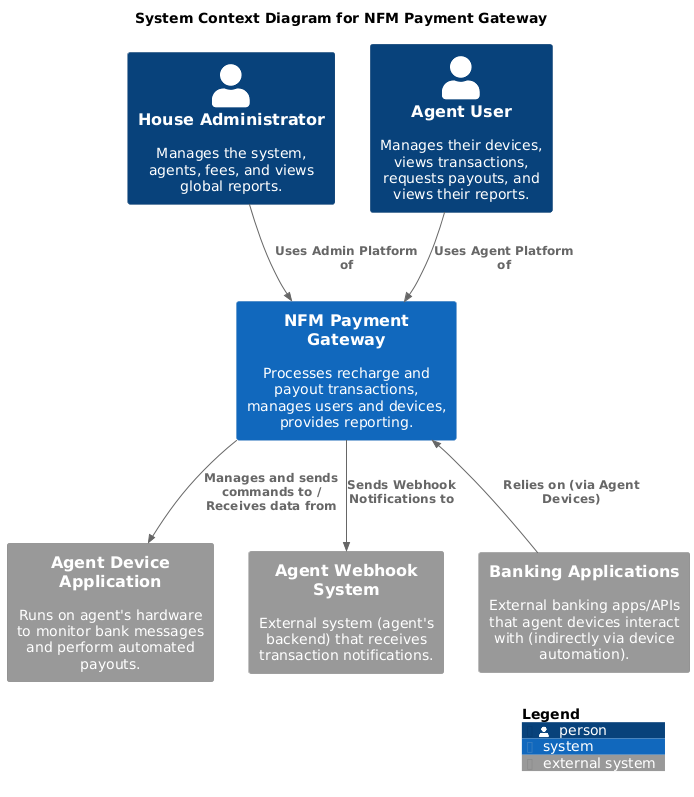

System Context

The system interacts with several external actors:

- House Administrators

- Agents

- Payment Devices

- External Banking Systems

Data Flow Examples

Recharge Workflow

- Agent device fecthing recharge transaction data

- Transaction is validated and processed

- Fees are calculated

- Notifications are sent to relevant parties

- Transaction is recorded for reporting

Payout Workflow

- Agent initiates payout request

- Request is validated against balance/limits

- Appropriate device is selected for automation

- Payout is executed and status tracked

- Transaction is recorded and notifications sent